Be Part of the Future of Bulk Shipping Intelligence

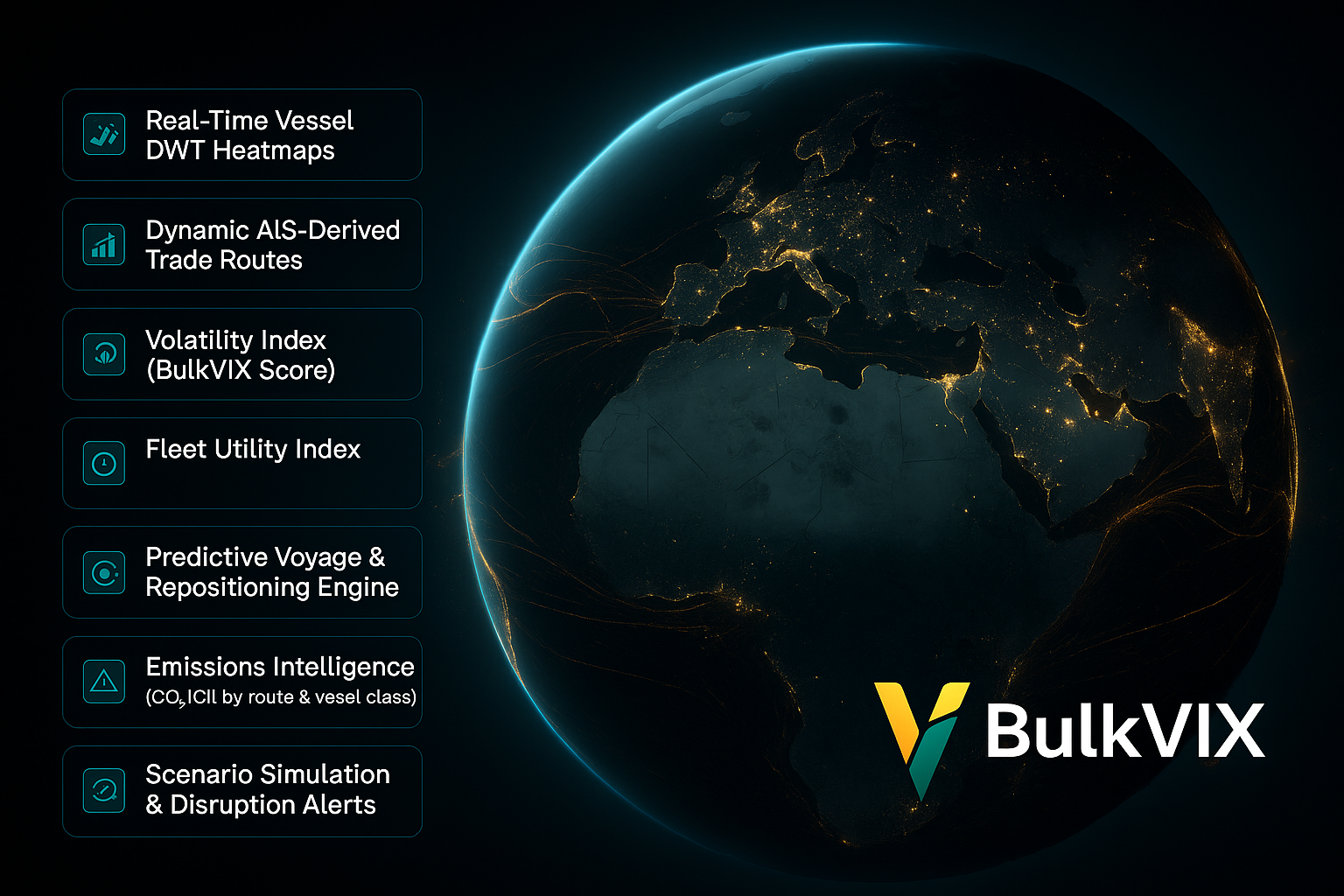

BulkVIX is currently in its active development phase — building the world’s most advanced AI-powered route intelligence and predictive analytics engine for the dry bulk market.

We are now opening the doors for:

Strategic collaborators

Early investors

Co-founders with technical or industry expertise

Data partners, maritime analysts, and AI engineers

If you believe in transforming bulk shipping through real-time intelligence, route-level forecasting, and next-generation decision systems, BulkVIX welcomes you to join our journey.

Let’s build the future of bulk freight analytics — together.

WHY NOW?

The tools required to operate in this new environment do not exist — yet.

The dry bulk market is undergoing a structural transformation. Volatility is rising, trade flows are shifting, and regulatory pressure is increasing. Yet the industry still operates without real-time supply–demand visibility or predictive intelligence.

While Satellite data is now abundant and vessel behavior is fully observable, the industry still relies on:

assessment-based indices

static benchmark routes

fragmented market insights

manual decision-making

backward-looking price signals

At the same time:

Fleet repositioning cycles are becoming shorter

Market volatility is increasing

Commodity flows are changing direction

FFA liquidity is growing every year

Environmental and CII regulations require data-driven transparency

AI adoption is accelerating across all global logistics sectors

This mismatch has created a fundamental disconnect between real market dynamics and the indices used to trade freight.

Non-Liquidity in Freight Financial Markets

· Actual vessel movements differ significantly from the predefined benchmark routes used by exchanges.

· Index vessels do not represent actual tonnage distribution or operational characteristics.

· Panel-based assessments can diverge from true market behaviour, especially during volatile periods.

This reduces trader confidence, widens bid–ask spreads, and directly contributes to non-liquidity in several forward curves. BulkVIX solves this by building AI-native, AIS-driven route indices that reflect actual vessel flows, lane densities, repositioning cycles, and supply–demand imbalances.

This is the Perfect Time for BulkVIX

1. Satellite data is now accurate, global, and real-time.

The technical foundation finally exists to model true market behaviour.

2. Machine learning can forecast short-term freight dynamics.

4–8 week predictive analytics are now feasible with modern ML architectures.

3. FFA markets urgently need better correlation.

A new benchmark aligned with real vessel movement is needed to restore liquidity.

4. ESG & CII regulations require transparent route-level analytics.

Static indices cannot satisfy emerging compliance requirements.

5. Digitalization in shipping is accelerating — but intelligence is missing.

Many tools exist; none provide unified supply–demand + forecasting + indexing.

6. The competitive landscape is wide open.

No existing platform provides a fully Satellite-native predictive ecosystem.